Advantages of Currency Options

The currency option bond gives the bondholder the right to receive the principal and interest payments in either USD or GBP. Advantages of vanilla options.

Unlike currency forwards where you buy currency for a specific date in the future and are locked into the deal.

. It also gives clients the possibility of profiting from positive developments in the forex market. The expense of setting the option up. Second it can compare with future rate which provide the chance to choose the most benefit.

First an Australian corporation can uses currency options to get right in order to hedge its exposure in euros. As such an investor can obtain an option position similar to a stock position but at huge cost savings. A currency option is a right but not an obligation to buy or sell a currency at an exercise price on a future date.

Your risk is limited to the cost of the premium you paid for the option to do so. Therefore the exchange rate remains 1 080 through the bonds lifetime. When you purchase an Option CallPut you are then allowed to purchase the.

Currency options are a tool for hedging foreign exchange risk. Some strategies like buying options allows you to have unlimited upside with limited downside. See answer 1 Best Answer.

There are many advantages of currency options trading. The best rated Advantages of Currency Options broker IC Markets offers competitive offers for Forex CFDs Spread Betting Share dealing Cryptocurrencies. Currency trading is a specialized skill and requires familiarity with the economies of the countries whose currencies you will trade as well the mind-sets of the major buyers and sellers in the currency markets.

This bond is known as a 5 USDGBP bond. To use currency options to take advantage of this situation the trader could simultaneously purchase a USD CallJPY Put option with a strike price placed at the level of the triangle patterns upper descending trend line as well as a USD PutJPY Call option struck at the level of the triangles lower ascending trend line. Roboforex minimum deposit is 1.

The main difference between the two is that in currency options trading their values are determined at a specific time period. This is a big advantage unlike the foreign exchange market that operates 24. Options can help you handle some of the challenges in the currency markets.

However it can be tricky to get a good fill during periods of high volatility. When buying CURRENCY OPTIONS the client has the option to buy or sell the given currency at a pre. Third options can be used to limit losses by hedging.

Options allow you to employ considerable leverage. A foreign exchange FX option is a type of contract that gives the buyer the right but not the obligation to buy one currency and sell another at an agreed rate of exchange at a point in the future. With OTC FX options you pay a premium for the right to buy the currency.

Unlike currency forwards where you buy currency for a specific date in the future and are locked into the deal. Trade Call and Put Options on our Award Winning Platform. An example of a vanilla option is to buy the.

Ad Access 1200 listed Options 44 FX Vanilla Options. Youre protected from any adverse movements in the exchange rate. IC Markets minimum deposit is 200.

If you change your mind you dont have to. If youre an investor seeking to enhance your portfolio the information below can offer you with the required assistance. Also the listed options are regulated.

For example to purchase 200. One of the other advantages of trading forex is that it takes relatively less trading costs than other markets. Ad Access 1200 listed Options 44 FX Vanilla Options.

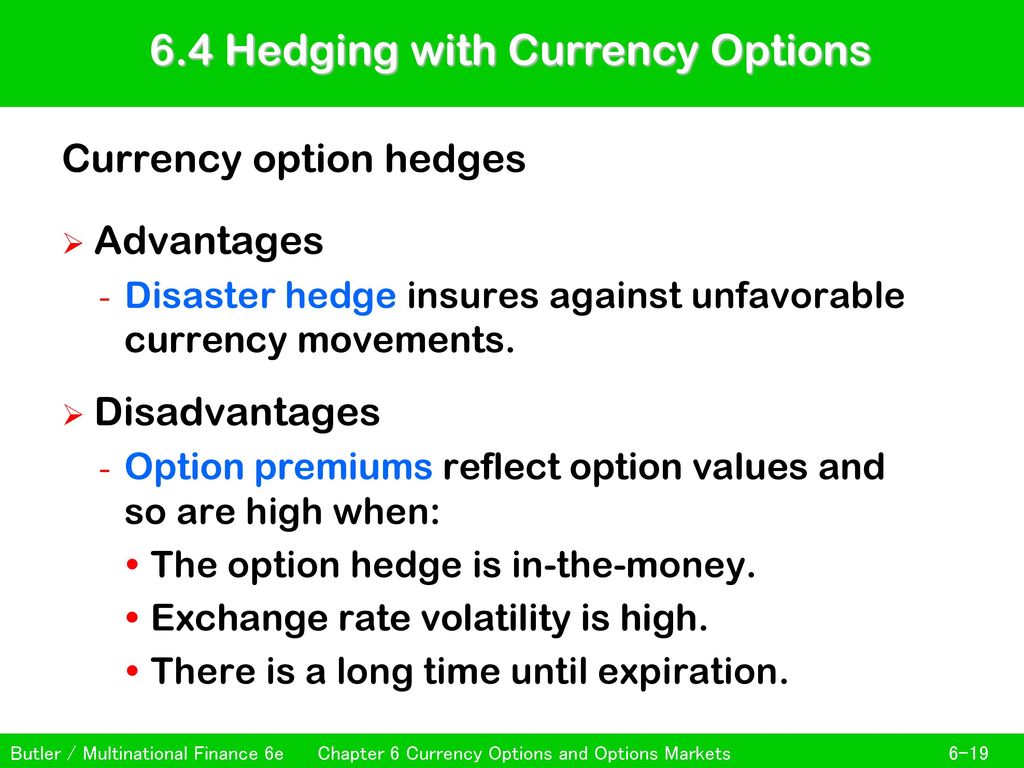

Forex Options currency Options Trading offers you with hedging your risks and yields high returns. Losses can exceed deposits. Disadvantages of buying currency options.

This is an advantage to disciplined traders who know how to use leverage. Advantages of OTC FX options. The annual coupon is 5 or 4.

If there is a favourable movement in rates the company will allow the option to lapse to take advantage of the favourable movement. The most basic form of an FX option but still very effective. Advantages of currency options.

This is known as a vanilla option. Advantages of buying currency options. Advantages of currency option.

Vanilla options provide protection against adverse movements in the exchange rate of the currency pair during the term of the contract. 10 advantages of Forex Options Trading. Options allow you to create unique strategies to take advantage.

Unfortunately from the perspective of the buyer high volatility equates to higher option prices since there is a higher probability that the counterparty will have to make a payment to the option buyer. Options have great leveraging power. It is not an obligation it.

Losses can exceed deposits. If you change your mind you dont have to. Advantages of using currency options Euros.

A CURRENCY OPTION is a financial instrument for hedging against risks that may arise from potentially negative developments in a currency pair. Trade Call and Put Options on our Award Winning Platform. Your risk is limited to the cost of the premium you paid for the option to do so.

The exchange rate and the coupon rate are fixed at the time of purchase. Another top rated Advantages of Currency Options broker Roboforex offers Forex CFDs. The ability to buy currency options is.

Only available to companies with large foreign exchange exposures. The buyer of a vanilla option is under no obligation to exchange currencies and is therefore able to participate in all favourable exchange rate movements. Your business can benefit if the exchange rate moves in your favour.

There is also the possibility of slippage during periods of instability just as in any other market. With OTC FX options you pay a premium for the right to buy the currency. Foreign currency options are particularly valuable during periods of high currency price volatility.

Advantages of Foreign Currency Options. The Advantages of Currency Options. Advantages of OTC FX options.

This way when the breakout occurs and volatility in. Advantages of currency options.

Free Currency Tips Stock And Nifty Options Tips Commodity Tips Intraday Tips Rupeedesk Shares Day Trading Day Trading Stock Options Trading Trading Charts

/close-up-of-computer-monitor-946388998-a64b758052274786b2c0a57891cf9fce.jpg)

No comments for "Advantages of Currency Options"

Post a Comment